Safe, Affordable Housing with Services is Focus of FJC’s First-Ever Multi-Donor Revolving Fund

What are the goals of FJC’s Revolving Fund for The Fortune Society?

FJC, a boutique sponsor of Donor Advised Funds, has arranged a fund that will empower The Fortune Society, a nonprofit serving vulnerable New Yorkers coming out of incarceration, to scale its housing development work. People re-entering society from prison are overrepresented in the homeless population, and supportive housing (affordable housing with services) has proven to be an effective strategy to keep vulnerable New Yorkers stable and out of crisis systems (like homeless shelters, hospitals, and jails). The initiative will help The Fortune Society double its housing portfolio over the next five years.

Specifically, the fund will:

- Support people coming out of prison with stable, permanent supportive housing and services;

- Provide The Fortune Society with the capital necessary to invests in its future and organizational growth by doubling its real estate portfolio over the next five years; and

- Allow FJC to demonstrate how Donor Advised Fund (DAF) accounts can be put to work for maximum impact, thereby helping them be more creative with their resources and support a greater number of people in need.

How are funds in the Fortune Society Revolving Fund different from other Donor Advised Fund accounts at FJC?

The Revolving Fund has been funded with philanthropic capital with a specific intention to help The Fortune Society act entrepreneurially to expand and scale its mission. The goal is to use the same dollars multiple times to initiate multiple projects, preserving the capital for donors to recycle again for philanthropic purposes.

A typical Donor Advised Fund (DAF) account at FJC provides recommender privileges to donors regarding how the philanthropic dollars in their accounts are invested for growth or deployed as grants. With the Revolving Fund, donors have agreed to “lock up” their funds for five years, to allow The Fortune Society to use them to advance their mission to expand their portfolio of permanent supportive housing for people coming out of incarceration. This agreement is documented in a simple Memorandum of Understanding between the donors and FJC.

The participating donors have agreed to allow The Fortune Society to draw on these funds as needed, as loans at 1% interest, instead of the typical ways funds in DAF accounts are used (i.e. granting funds out, or investing them for tax-free growth to make grants at a future date). At the end of the five-year term, The Fortune Society will repay the loans, and funds will return to the donors’ individual DAF accounts. These loans are documented in a loan agreement between FJC as lender and The Fortune Society as borrower.

Who is The Fortune Society?

Founded in 1967, The Fortune Society has advocated on criminal justice issues for over five decades and is nationally recognized for developing model programs that help people with criminal justice histories to be assets to their communities. The Fortune Society offers a holistic and integrated “one-stop-shopping” model of service provision. Among the services offered are discharge planning, licensed outpatient substance abuse and mental health treatment, alternatives to incarceration, HIV/AIDS services, career development and job retention, education, family services, drop-in services, and supportive housing as well as lifetime access to aftercare.

Developing, owning and operating housing is core to Fortune Society’s work. Low-threshold access to supportive emergency, transitional, and permanent housing is provided at their congregate facilities, The Fortune Academy (“the Castle”) and Castle Gardens, along with their Scatter-Site Housing program.

What is supportive housing?

Supportive housing is affordable housing with onsite services that help formerly homeless, disabled tenants live in dignity in the community. Supportive housing came into being in response to the homelessness crisis in New York City in the 1970s and is the most humane and cost-effective solution to ending homelessness for vulnerable people: individuals and families dealing with mental illness, trauma/abuse, addiction, and chronic illness including HIV/AIDS.

Supportive housing is permanent and affordable: All tenants hold leases and pay about a third of their income in rent. The residences are owned and operated by nonprofit organizations and are accountable to their city, state, and federal funders. Because supportive housing either replaces a blighted building or lot, it jump-starts neighborhood renewal. Because it provides 24-7 front desk coverage and other security features, supportive housing frequently contributes to increased community safety. As a result, studies have shown that supportive housing increases property values. For more about the cost effectiveness and impact of supportive housing, see these great resources at The Supportive Housing Network.

Depending on the site and service contracts, supportive housing is made available to vulnerable populations who are disproportionately represented in the homeless shelter system: such as people who face substance abuse, HIV/AIDS, serious persistent mental illness, veterans, and—in the case of The Fortune Society—people re-entering society after incarceration.

Why does The Fortune Society need resources from a Revolving Fund?

Nonprofits face particular business challenges when launching entrepreneurial activity. The ownership and governance structures of nonprofit organizations don’t allow them to raise equity. As a result, when nonprofits need to fund the earliest and most risky pre-development stage of a real estate venture, they must fund pre-development expenses from rainy day funds, if they exist, or else pull cash from their operating budget.

To scale its work in developing supportive housing, the Revolving Fund will provide The Fortune Society a dedicated source of capital that can be used to initiate these time-intensive, critical projects.

The total development costs of a typical supportive housing development may run into the tens of millions of dollars, depending on size, which is financed through a combination of private financing and federal, state, and city subsidies. To secure these resources, The Fortune Society incurs significant soft costs during the pre-development phase, which can run in the tens or hundreds of thousands of dollars. These costs include deposits to secure sites for acquisition, feasibility studies, environmental reviews and architectural design work.

How will The Fortune Society repay loans and replenish the Revolving Fund?

Fortune Society will replenish the revolving fund when their affordable housing projects secure construction or permanent financing, or bridge loans from more traditional financing partners.

The federal Low Income Housing Tax Credit (LIHTC) is the principal subsidy for affordable housing development, and the New York City region receives an allocation of LIHTC through its housing finance agencies NYS Housing & Community Renewal (HCR) and the NYC Department of Housing Preservation & Development (HPD). These resources are supplemented by tax-exempt bond financing, grants from other public and private sources, and traditional bank financing. In addition to these capital sources, nonprofits must secure service contracts from other city and state agencies.

The Fortune Society has a long track record of securing these sources, as well as the necessary public approvals from community boards and other elected officials.

Is there a risk that loans won’t be repaid?

No investment is risk-free. FJC mitigates this risk by working with The Fortune Society to fund activities that have a high likelihood of repayment, on real estate projects that have already secured significant public approvals and/or soft commitments of public resources. The primary motivation of this fund is philanthropic (and at 1% interest, the loans are being made available at below-market interest rates). Nevertheless, this project will be deemed successful if the loans are repaid and the donors have the opportunity to recycle them for other philanthropic purposes.

The loans made from The Revolving Fund are general recourse obligations to The Fortune Society, meaning that if the real estate projects in the early planning stages don’t go forward (the primary source of repayment), The Fortune Society is still “on the hook” to repay them (the secondary source of repayment). The Fortune Society is in a strong financial position, and has never failed to repay any debt obligation on time.

Working on behalf of its donors, FJC will make all efforts to recover the full loan principal in the event that things do not go as planned. In the remote possibility that a loan recovery becomes impossible, FJC will convert to a grant any portion of the loan deemed to be uncollectible.

We have worked closely with donors to understand the risks involved in this Revolving Fund. Our expectation is that every dollar dedicated to this effort will be used multiple times to initiate multiple projects and then returned to donors’ DAF accounts so they can be redeployed as grants.

What happens at the end of the 5-year term?

At the end of a 5-year term, funds will be returned to the initial donors’ DAF accounts. The account holders will then have the flexibility to recommend their funds be granted to the nonprofits of their choice.

Where does the initiative stand now?

Four DAF account holders at FJC have joined this effort, including Gary Hattem, Theodore Huber, A to Z Impact, and an anonymous donor. As of this writing (5/15/23), The Fortune Society has drawn $400,000 to cover pre-development expenses on two projects:

- Just Home Project is an innovative housing initiative that will provide permanent, supportive housing with services for medically complex homeless New Yorkers returning after incarceration. Residents of this project suffer from medically complex issues that require constant medical attention. The project is a partnership with the NYC Health + Hospitals Corporation and will be built on City-owned land at the Jacobi Medical Center (Bronx, NY).

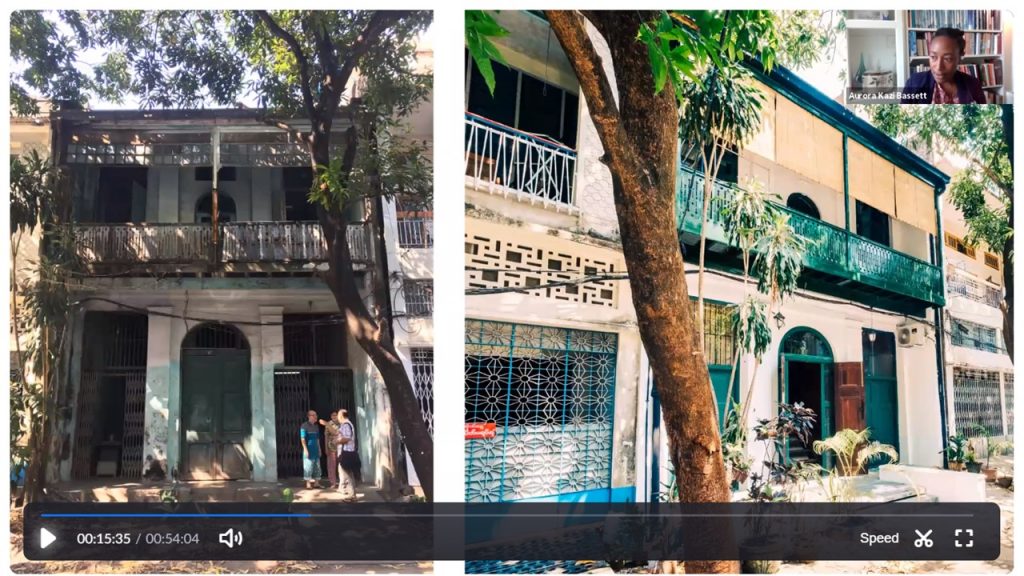

- Illegal Hotel Conversion. Redevelopment of “illegal hotel” to supportive and affordable Single Room Occupancy (SRO housing at 258 West 97th Street in the Upper West Side. The completed project will have 59 supportive housing units and 25 affordable units. The project was the subject of a New York Times article “From ‘Illegal’ Hotel to Housing for the Homeless on Upper West Side” (3/28/22).

Funds will be used to cover architectural services, environmental reviews, consultant fees, and staff management costs. It is anticipated that over the next year, these projects will close on pre-development or construction financing that will enable The Fortune Society to repay the loans and draw on the fund again for other projects in their supportive housing pipeline.