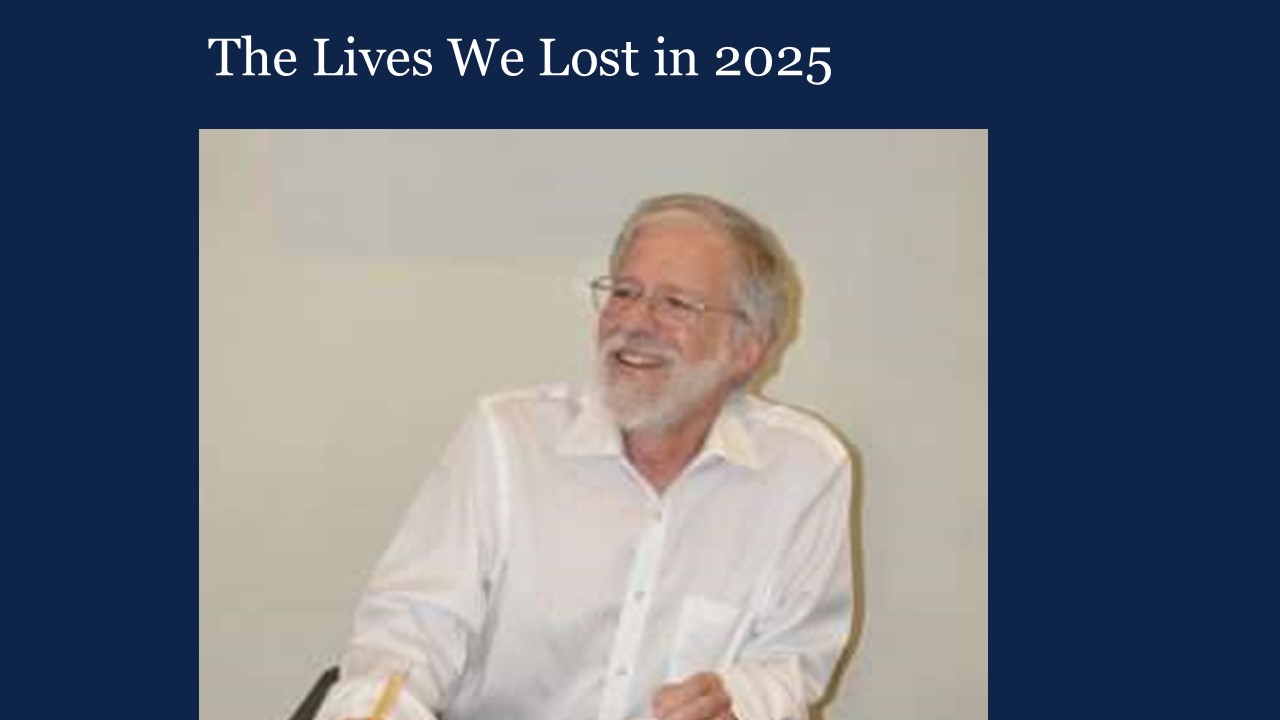

This year saw the passing of longtime FJC donor Andrew Lachman, whose commitment to public education spanned his whole career, including his philanthropic giving in retirement.

Mr. Lachman was born in New York City in 1947 and grew up in Westchester and Connecticut. He began his career in education after graduating from University of Chicago, first as a teacher and later as a public school administrator, and then as the Chief Executive Officer of the nonprofit Connecticut Center for School Change (now known as Partners for Educational Leadership). There, among many innovations, he developed the concept of instructional rounds, a process that school districts and schools use to observe teaching and improve learning at scale.

As current PEL executive director Richard Lemons wrote in an obituary of Mr. Lachman:

Andrew’s leadership helped define a new chapter in the life of the Center. During his tenure, he sharpened the organization’s focus on large-scale systems improvement, with particular emphasis on districts as the unit of change. He recognized that to create a lasting impact, we had to work not only with teachers and schools—but with the ecosystems and leadership structures that surround them.

Andrew was more than an organizational leader—he was a culture builder. He nurtured an environment of high expectations, collaborative inquiry, and reflective practice. He invited people to think big and act with discipline. He modeled intellectual generosity and principled decision-making. And he believed in people—deeply. As a result, many of us who worked with Andrew not only grew professionally, but also came to see more clearly what leadership with heart and intellect can look like.

Mr. Lachman’s support of PEL continued long after he stopped working there. Through his DAF at FJC, he provided multiple years of support to the organization. He and his wife Ruth Messinger also provided a major grant to the Hebrew Free Loan Society to fund a program that helped hundreds of New Yorkers refinance predatory credit card debt.

As his wife Ms. Messinger recalls:

Andrew came from a lovely well-off kind family that did not have any orientation to charitable giving.

When we were about to be married, after years of knowing each other, working together and becoming a couple, he asked if there was anything about me he didn’t know. I thought and said, yes, I’m a tither.

Andrew did not know what that was and found it hard to believe I had been tithing at points in my life when I had very little money. That said, he became an enthusiastic participant in all of our giving—particularly charitable giving to not for profit organizations that spoke to our shared interests.

FJC mourns the passing of Mr. Lachman and looks forward to working with his family to continue his philanthropic legacy.